BOC PPIT Debit Card “Together with Community, Build the Future”

BOC PPIT Debit Card is a debit card issued by Bank of China (Hong Kong)Limited Jakarta Branch (“Bank”) equiped with Perhimpunan

Pelajar Indonesia Tiongkok (“PPIT”) logo, and is an exclusive debit card made for customers that is a member of PPIT. BOC PPIT debit card can be utilized for dual currencies transactions, in Indonesian Rupiah (IDR) and Chinese Yuan (CNY). For the transactions that was done by customer as the BOC PPIT debit card holder (i) transaction outside China Mainland, Bank will deduct card holder's IDR account; (ii) transaction at China Mainland, Bank will deduct card holder's CNY account.

Exclusive privilege

Enjoy 1% cashback up to maximum CNY 600 every month, for transactions using Your debit card in China Mainland.

Enjoy 10% discounts while doing transaction with minimum CNY 200 at over 100 merchants in Guangxi Province, start from hotel, retail, restaurant, travel agency, to health category. Please click here for more offer details. Other than that, also enjoy various offers by UnionPay International with the detail provided on this link.

BOC PPIT debit cardholders also entitled to enjoy special discount for Hanyu Shuiping Kaoshi/HSK test fee.

In addition, when travelling to Hong Kong and Macau, you could also enjoy privileges offers when using your BOC Debit card*.

*Offers are applicable to BOC Debit Card bearing the  logo. The offers are valid until 31 December 2025 (unless otherwise specified). All services and offers are subject to relevant terms and conditions. Please click here for more offer details or enquire with respective merchants.

logo. The offers are valid until 31 December 2025 (unless otherwise specified). All services and offers are subject to relevant terms and conditions. Please click here for more offer details or enquire with respective merchants.

Other than that, BOC PPIT Debit Card also provide privileges and benefits to the card holders such as:

- Included in SplendorPlus program that Customer can enjoy cashback when spending in China Mainland. Please access this page for further information regarding the terms and conditions of SplendorPlus program.

- One card two currencies, avoid foreign exchange when doing transaction at China Mainland.

- Enjoy fee-free transactions by binding your card to Alipay and Wechat Pay, enjoy more convenient transaction’s experience in Mainland China.

- Broader network coverage, other than NPG network, ATM BERSAMA, PRIMA (in Indonesia) also covers UnionPay network (in China Mainland).

- Card equipped with standardized Chip + PIN, provide customer with more secure and convenient transaction experience.

- Easy access to BOCNet and BOC Mobile, provide secure and convenient transaction experience.

- Free BOC PPIT debit card monthly admin fee by applying BOC PPIT Debit Card and register BOCNet.

- UnionPay International network provide worldwide convenient purchasing experience.

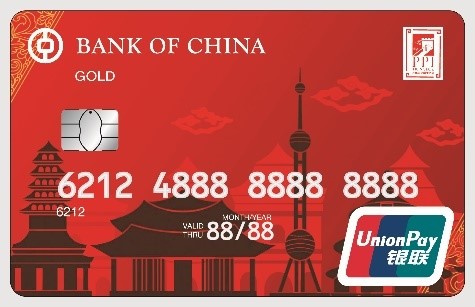

Debit Card Design

Debit Card Features

Card Type

|

Currency

|

Domestic Transaction Services

|

Overseas Transaction Services

|

|---|---|---|---|

BOC PPIT Debit Card |

IDR and CNY |

|

|

Transaction Limit

| Transaction Type | Rupiah (IDR)* | Chinese Yuan (CNY)* |

|---|---|---|

Cash withdrawal

|

15,000,000

|

7,500

|

Transfer through ATM

|

50,000,000

|

- |

Purchase / POS

|

50,000,000

|

Default Limit: 50,000

Maximum Limit: 80,000

|

Online Payment

|

Default Limit: 25,000,000

Maximum Limit: 50,000,000

|

Default Limit: 12,500

Maximum Limit: 50,000

|

*

- For the transactions that was done by customer as the BOC PPIT debit card holder (i) transaction outside China Mainland, Bank will deduct card holder’s IDR account; (ii) transaction at China Mainland, Bank will deduct card holder’s CNY account.

- Customer can change BOC PPIT debit card transaction limit setting by visiting the nearest Sub-branch office.

- If utilizing existing account that is linked to other debit card (e.g NPG debit card), the card limit will be combined between the two cards (NPG+UnionPay)

Fees & Charges

Type of Charges

|

Charges amount

|

|

|---|---|---|

Debit card application fee

|

Free of charge

|

|

Debit card replacement fee

|

Due to expired or broken card

|

Free of charge

|

Change from student card to BOC PPIT Card

|

Free of charge

|

|

Due to lost or stolen card

|

IDR 50.000

|

|

Debit card monthly fee |

Apply 1 debit card

|

IDR 5.000

|

Apply 1 debit card + internet banking

|

Free of charge

|

|

Apply 2 debit cards (CUP + NPG)

|

IDR 5,000 for UnionPay Debit Card type, Free of charge for NPG debit card type

|

|

Transaksi through ATM machines

|

||

Cash withdrawal*

|

In Indonesia (through ATM BERSAMA and PRIMA network)*

|

IDR 5.000

|

Other than Indonesia and China (UnionPay Network)

|

IDR 50.000

|

|

China Mainland (UnionPay Network)**

|

CNY 25

|

|

Transfer

|

In Indonesia (ATM BERSAMA and PRIMA Network)

|

IDR 6.500

|

Balance inquiry

|

In Indonesia (through ATM BERSAMA and PRIMA network)

|

Free of charge

|

Other than Indonesia and China (UnionPay Network)

|

IDR 4,000

|

|

China Mainland (UnionPay Network)

|

CNY 2

|

|

Retail Transaction / Purchase

|

||

Purchase / POS

|

Merchant equipped with NPG, ATM BERSAMA, PRIMA, or UnionPay logos

|

Free of charge

|

* Free 10 times per month for UnionPay PPIT debit card (combined between ATM BERSAMA and PRIMA network)

** Free 1 time per month for UnionPay PPIT debit card

Eligibility

- Indonesian citizen that is a student or member of PPIT

- Student or PPIT member that applied for joint account “Or” type only (joint account “And” is not eligible to apply for debit card)

BOC PPIT Debit card application procedure

Student

|

Parents

|

|---|---|

Identity Card (for children below 17 years old can utilize birth certificate)

|

Identity Card

|

Admission Letter

|

NPWP / Tax ID

|

Family register or birth certificate

|